In the process of purchasing a home, comprehending the condition of the property is vital for forming an informed decision. This is where qualified Level 2 inspectors come into action, providing expertise that can help homebuyers steer clear of financially burdensome mistakes. A Level 2 home survey delivers a detailed evaluation of a property's condition, centering on the structural elements and detecting potential issues that may not be apparent right away. For those entering the market for the first time, this can be a crucial step in navigating the challenges of the homebuying journey.

In this manual, we will explore what a Level 2 home survey includes, how it contrasts from other types of surveys, and when it is recommended to obtain one. From typical issues spotted by surveyors to understanding the results of your survey report, we will provide you with the insight needed to make a confident choice. By the conclusion, you'll understand not only the importance of a Level 2 survey but also how it can strengthen you in negotiations and ultimately conserve you money.

Grasping Level Two Home Surveys

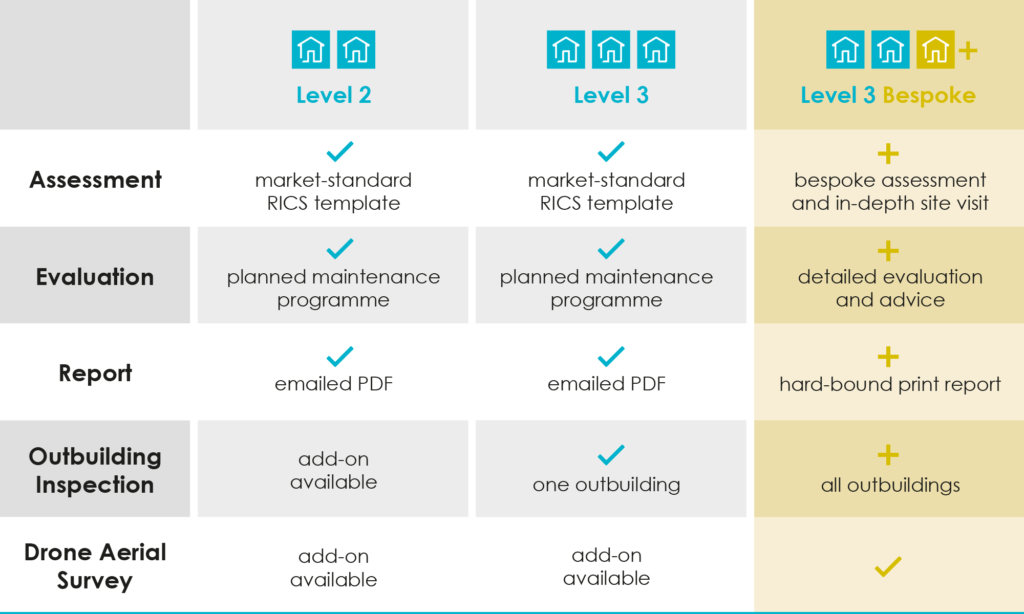

A Level 2 home survey, also known as a Homebuyer Report, is a thorough inspection customized for future homebuyers. It provides a comprehensive assessment of the property's state, highlighting on any noteworthy structural issues, repairs needed, or probable risks. This type of survey is typically more detailed than a Level 1 survey, making it suitable for standard homes in adequate condition, but not as comprehensive as a Level 3 survey, which is reserved for properties that may require thorough investigation.

The Level 2 survey covers a variety of aspects within the property, including the roof, walls, floors, windows, and services such as plumbing and electrical systems. The surveyor detects any overt defects and provides an evaluation of their likely consequences on the property value and safety. This report is especially valuable for novice buyers who may not be familiar with the details of property condition, enabling them to make knowledgeable decisions before purchase.

Additionally, understanding what is part of and omitted in a Level 2 survey is crucial for buyers. While additional reading provides thorough insights into the property's condition, it does not usually include a valuation or offer advice on the price of the property. Buyers should also be mindful that any inaccessible areas may not be inspected, and it's advised to emphasize a survey to avoid unexpected expenses after the purchase.

Advantages and Drawbacks of Level 2 Surveys

Level 2 surveys offer many benefits for homebuyers, particularly those purchasing older properties or those that may have hidden defects. level 2 surveys of the main advantages is the thorough assessment of a home’s condition, which entails a visual inspection and in-depth reporting on issues such as dampness, roof damage, and structural integrity. This carefulness can enable buyers with knowledge, enabling them to make knowledgeable decisions and possibly negotiate more favorable purchase prices according to the findings.

However, there are risks involved with opting for a Level 2 survey as well. For certain buyers, the cost may appear significant, leading them to question whether the investment is justified. It is crucial to balance the potential costs of repairing hidden issues against the survey cost. Additionally, while Level 2 surveys are generally detailed than basic inspections, they do not cover every aspect or guarantee an exhaustive analysis; thus, certain issues may remain hidden despite a Level 2 assessment.

In making the choice to proceed with a Level 2 survey, buyers must weigh both the possible benefits and risks. While the survey provides valuable insights that can avert future headaches and financial losses, there is also the chance of discovering significant issues that could dissuade a buyer from proceeding with the purchase. Ultimately, understanding these dynamics can lead to a much confident and informed homebuying experience.

Selecting the Suitable Surveyor

In regards to picking a Type 2 surveyor, credentials and experience should be your top priority. Look for assessors who are certified with a recognized professional body, such as the RICS. This membership ensures that they follow professional standards and best practices. Additionally, take into account their background with properties similar to yours, as local knowledge can significantly influence the completeness of the survey.

It is also essential to request from potential assessors specific questions about their techniques and what they will inspect in depth. A good assessor should be receptive to explaining what their assessment will entail, covering any instruments or techniques they will use. Seek out referrals or feedback from previous clients to assess their contentment and find out how well the surveyor communicates findings. Effective discussion can make a significant difference in understanding the survey findings.

In conclusion, don’t forget to talk about fees upfront. While level 2 survey should not be the sole determining factor, being open about cost can help avoid any unforeseen charges. Request a itemized quote that outlines the fees and includes any extra offerings they may provide, such as post-assessment discussions or advice on repairs. Making an informed decision will ensure that you choose a assessor who will deliver a thorough and precise assessment, that will aid your real estate transaction.